south carolina inheritance tax 2020

Manage Your South Carolina Tax Accounts Online. Writer must be at least 18 years.

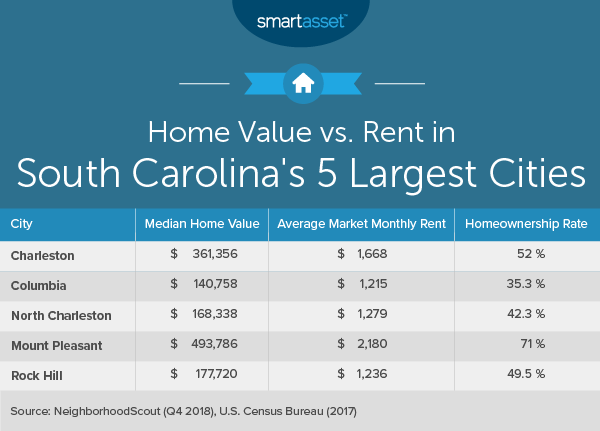

South Carolina Estate Tax Everything You Need To Know Smartasset

There are seven states that assess an inheritance tax so make sure to ask your accountant if you think you may be subject to it.

. There are both federal. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. The following five states do not collect a state sales tax.

However the state does have its own inheritance laws that govern which beneficiaries will receive portions of an estate after a loved one dies. Alaska Delaware Montana New Hampshire and Oregon. South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Rachel CauteroMar 16 2022. However some of these states find ways to collect taxes in other forms.

Does South Carolina Have an Inheritance Tax or Estate Tax. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. South Carolina has a simplified income tax structure which follows the federal income tax laws.

South Carolina has no estate tax for decedents dying on or after January 1 2005. South Carolina also does not impose an Estate Tax which is a tax taken from the deceaseds estate soon after the loved one has passed. These credits should be reported in Schedule 06 on the South Carolina Premium Tax.

For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. Individual income tax rates. 4 The federal government does not impose an inheritance tax.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. While South Carolina itself does not levy inheritance laws there may be cases when the states resident would still owe a related tax due.

Will must be signed by the writer and two. Most of these credits correspond with credits to tax liabilities offered in Chapter 6 of Title 12 of the South Carolina Code. In this detailed guide of South Carolina inheritance laws we break down intestate succession probate taxes what makes a will valid and more.

South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of estates. However you are. Not every state imposes the Inheritance Tax and South Carolina is one of many that does not.

You are liable for estate taxes only if the estate itself did not set aside money for this purpose and only if the value of the estate exceeds the taxable threshold. Your federal taxable income is the starting point in determining your state income tax liability. A federal estate tax is in effect as of 2021 but the exemption is significant.

South Carolina does not assess an inheritance tax nor does it impose a gift tax. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. The SC Department of Revenue publishes online tutorials and sponsors tax seminars and workshops throughout the. Determine whether you are responsible for paying federal estate tax on your inheritance.

Securely file pay and register most South Carolina taxes using the SCDORs free online tax portal MyDORWAY. Estate taxes apply to the estate itself not the inheritor. For example 62 localities in Alaska collect local sales taxes ranging from 1 percent to 7 percent.

Creating a will is oftentimes the first step that South Carolina residents must take in estate planning. In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. April 14 2021 by clickgiant.

On June 16 2021 the governor signed SF 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning January 1 2021 through December 31 2024 and results in the repeal of the inheritance tax as of January 1 2025. Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million in 2020. But if you live in South Carolina and you receive an inheritance from another estate you could be subject to inheritance tax in that state.

Writer must be of sound mind and body. 117 million increasing to 1206 million for deaths that occur in 2022. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

In case you inherit a property from a resident of another state you will have to pay that states local inheritance tax. Act 231 of 1996 allowed certain tax credits for insurers to spur economic growth and development in certain areas of South Carolina. The District of Columbia moved in the.

Check the status of your South Carolina tax refund. However that does not mean that there are no taxes or fees that are imposed on an estate in South Carolina. Large estates that exceed a lifetime exemption of 1206 million are subject to the federal estate tax.

Delaware collects a gross receipts tax from businesses. The requirements for a valid will change from state to state but are pretty straightforward in South Carolina. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

South Carolina Paycheck Calculator Smartasset

Best Places To Live In North South Carolina

South Carolina Sales Tax Small Business Guide Truic

A Guide To South Carolina Inheritance Laws

Revealed Living In South Carolina Vs North Carolina This May Surprise You Youtube

South Carolina Covid Employment Tax Withholding Requirements

Moving To South Carolina 12 Reasons You Ll Love Living In Sc

South Carolina Estate Tax Everything You Need To Know Smartasset

Cost Of Living In South Carolina Smartasset

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Sales Tax Guide And Calculator 2022 Taxjar

2022 Best Places To Live In South Carolina Niche

South Carolina Retirement Tax Friendliness Smartasset